Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Unlocking The Potential: Nikkei 225’s Soaring Performance

TOPICSTags: Nikkei 225 Index, Topix Index

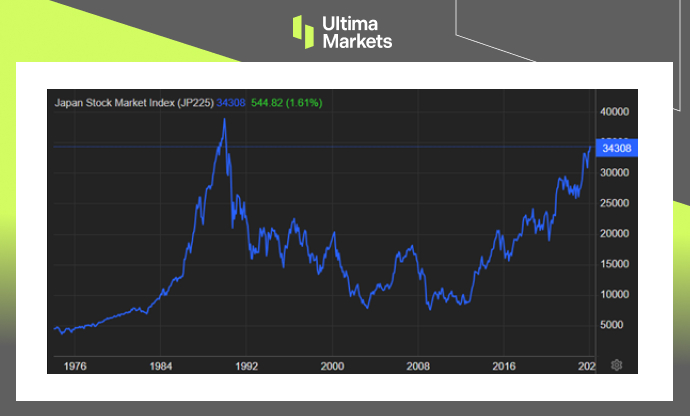

Nikkei 225 Reaches Over 30-Year High, Highest Level Since Japan’s Bubble Economy

Japan’s Nikkei 225 Stock Average has recently achieved a milestone, reaching levels not seen in over 30 years. The surge, fueled by a rally in technology companies, is setting a new benchmark for the blue-chip index. Let’s delve into the factors driving this remarkable performance and what the future may hold for investors.

The Remarkable Jump

On January 10th, the Nikkei 225 soared 1.2%, surpassing the 34,000 mark. This surge, reminiscent of Japan’s “bubble economy” era, has captured attention globally.

(Nikkei 225 Index 50-year Chart)

Technology companies played a pivotal role, with Tokyo Electron, Advantest, Socionext, Lasertec, and Disco Corp leading the charge. Other major index components, including Nintendo, Fast Retailing, and Sony Group, also posted significant gains.

A Year of Strength

The year 2023 witnessed impressive gains for both the Nikkei 225 and the Topix, each recording annual increases exceeding 25%. This robust performance marked their strongest showing in a decade.

Authorities encouraging companies to enhance shareholder value, coupled with a shift from long-standing deflation to mild inflationary pressures, contributed to this remarkable upswing.

Future Outlook

As we step into 2024, the optimism among investors remains palpable. The yen’s favorable valuation against other currencies and corporate profits demonstrating resilience to currency fluctuations contribute to the positive sentiment. With these factors in play, Japanese stocks may continue their upward trajectory in the coming year.

Exploring Nikkei’s Landscape

To gain deeper insights into the Nikkei 225, consider exploring its various facets through reliable sources:

- Nikkei Stock Average (Nikkei 225): Understand the profile and historical data of the Nikkei 225.

- Nikkei Stock Average, Nikkei 225 (NIKKEI225) | FRED: Access daily observations and market close values for the Nikkei 225.

- Nikkei 225 (^N225) Charts, Data & News: Stay updated on Japan’s Nikkei share average and related market news.

- Nikkei Stock Average Monthly Factsheet: Explore a comprehensive monthly factsheet for the Nikkei 225.

- NKY Quote – Nikkei 225: Gain insights into the price-weighted average of top-rated Japanese companies.

- Nikkei 225: Dive into the Wikipedia entry for detailed information on the Nikkei 225.

- Nikkei 225 Index (N225): Visit Investing.com for an overview of the Nikkei 225 as a stock market index.

- NIK | NIKKEI 225 Index Overview: Stay informed with MarketWatch for insights on Nikkei 225’s market overview.

- Nikkei 225 Index – 67 Year Historical Chart: Explore an interactive daily chart of Japan’s Nikkei 225 stock market index.

Frequently Asked Questions

Q1: What factors contributed to the recent surge in the Nikkei 225?

A1: The surge was driven by a rally in technology companies, with key players like Tokyo Electron, Advantest, and others leading the charge.

Q2: How did the Nikkei 225 perform in 2023?

A2: In 2023, both the Nikkei 225 and the Topix posted annual gains of over 25%, marking their strongest performance in a decade.

Q3: What can investors expect in 2024?

A3: Optimism prevails in 2024, with the yen’s relative affordability and corporate profits showing resilience, indicating potential further gains for Japanese stocks.

Bottom Line

The Nikkei 225’s recent surge reflects a resilient market, with technology companies at the forefront. As we navigate 2024, keeping an eye on the index and understanding its dynamics can provide valuable insights for investors.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server