On Thursday, Feb. 15th, the UK pound slightly decreased in value, dropping below $1.26 compared to the US dollar following the latest UK CPI data revealed. The figures alleviated concerns about escalating inflation pressure.

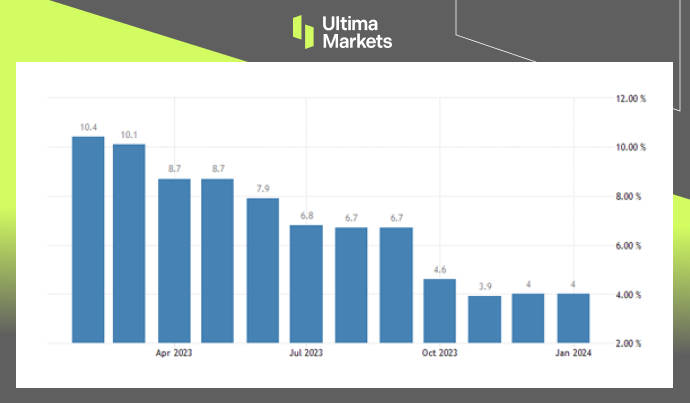

For January, the yearly inflation rate in the UK remained consistent at 4%, a bit lower than the anticipated 4.2%. The Bank of England (BoE) predicted a rise to 4.1% in its recent inflation estimates. However, the data also indicated a slower-than-expected slump in wage growth during the closing months of 2023, implying a longer cooling-off period for the UK employment market. Consequently, the Bank of England might postpone any possible interest rate reductions.

The forthcoming UK economic information includes Q4 GDP numbers, with market experts predicting a decline of 0.1%, which would technically plunge the UK into a recession. Conversely, January’s US inflation rate exceeded expectations, diminishing the prospects of immediate interest rate reductions from the Federal Reserve in March or May. This caused the US dollar to strengthen and further weakened the British pound. Most experts expect limited scope for additional monetary easing from the Bank of England or UK pound enhancements until a steady global price pressure decrease is evident.

(Inflation Rate, Office for National Statistics UK)

(GBPUSD Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4