Major averages on Wall Street stumbled on Tuesday, adding to previous declines triggered by a far-reaching sell-off in the tech sector and rising fears regarding a possible economic deceleration. A 1% fall was recorded by the S&P 500, the Dow Jones took a dive, dropping 404 points, while the Nasdaq receded by 1.6%. New data pointed to the ISM Services PMI being lower than anticipated, and factory orders took a steeper plunge than predicted.

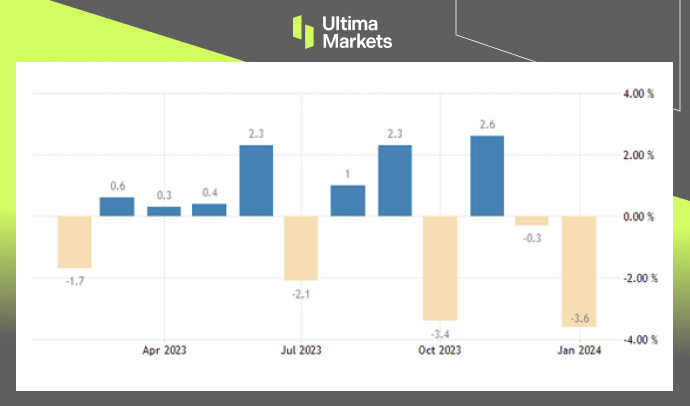

In January 2024, the demand for US manufactured goods experienced a downturn of 3.6% on a month-to-month basis, following a slight pullback of 0.3% in December. This figure was steeper than the market’s projected decrease of 2.9%. The slump marks the most significant one since April 2020, with noted decreases in orders for transportation equipment (-16.2%), primary metals (-1.9%), fabricated metal products (-0.9%), and machinery (-0.3%). Meanwhile, a positive stride was seen in the sectors of computers and electronic products, with an increase of 1.3%, and electrical equipment, appliances, and components with a boost of 0.9%.

(Factory Orders, US Census Bureau)

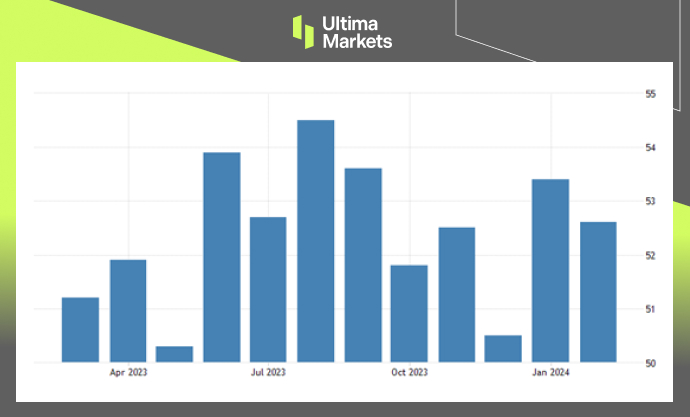

The Services PMI from ISM declined to 52.6 in February 2024, dropping from the previous four-month peak of 53.4 recorded in January, and falling short of the predicted 53. This indicates a slight deceleration in the growth pace of the services sector due to quicker supplier deliveries (48.9 compared to 52.4) and a decrease in employment (48 versus 50.5). Overall, most providers of services hold a predominantly positive view towards business conditions, despite harboring worries over inflation, employment, and continuing geopolitical confrontations.

(United States Services PMI, ISM)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4