Canadian Dollar Hits 10-Week Low Amid Softer Inflation Data

TOPICSTags: Bank of Canada, Canadian Dollar, Cut rate, Inflation, USDCAD

On Tuesday, Canada’s annual inflation rate slowed more than the expected of 1.8%, dropping to 1.6% in September from 2.0% in August. This easing in inflation was primarily driven by a significant decline in gasoline prices, which marked the smallest annual increase in consumer prices since February 2021, according to Statistics Canada. USD/CAD is trading near a 10-week low, having fallen 0.15% to close at 1.3775.

(USDCAD Daily Price Chart, Source: Trading View)

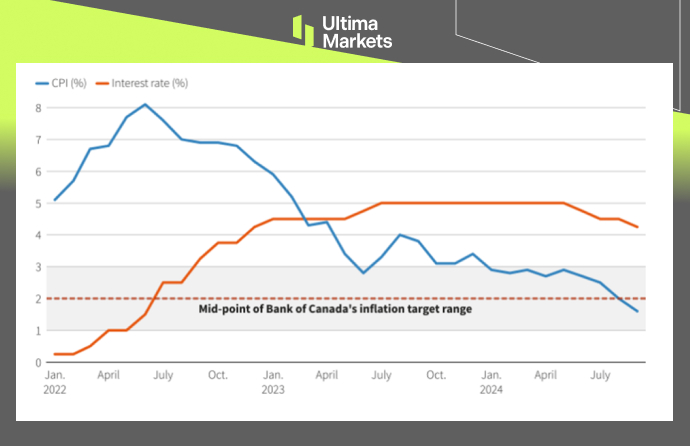

Consumer prices in Canada have steadily eased since the beginning of the year, reaching the midpoint of the Bank of Canada’s 1%-3% target range last month as high interest rates dampened consumer demand and business investments. As a result, the latest inflation data has prompted markets to increase bets on a 50-basis-point rate cut next week.

In fact, the Bank of Canada has already cut its policy rate by 25 basis points at each of its last three policy-setting meetings. Last month, Governor Tiff Macklem warned that inflation could fall below the target range and that economic growth might weaken, fueling hopes for a larger-than-usual 50-basis-point rate cut. Therefore, the Bank of Canada needs to take action to revive the economy and prevent inflation from dropping too far, with a 50-basis-point rate cut possibly being the right remedy.

(Canada Inflation and Interest Rate, Source: Statistics Canada)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server