Dollar Hits Multi-Month Lows Amid “Trumpcession” Fears

TOPICSTags: DXY, Trump, Trump Policy, US dollar

The U.S. Dollar Index fell to its lowest level in months yesterday, with the euro and the British pound emerging as the biggest gainers against the greenback. The recent shift in market sentiment was largely driven by concerns over Trump’s policies.

Dollar Sinks on “Trumpcession” Concerns

Earlier, Trump escalated tariff measures, raising fears among global investors about the economic outlook, particularly for the U.S. economy. This has fuelled risk aversion and reinforced concerns over a potential recession—referred to as a “Trumpcession,” a term describing an potential economic downturn triggered by Trump’s policies.

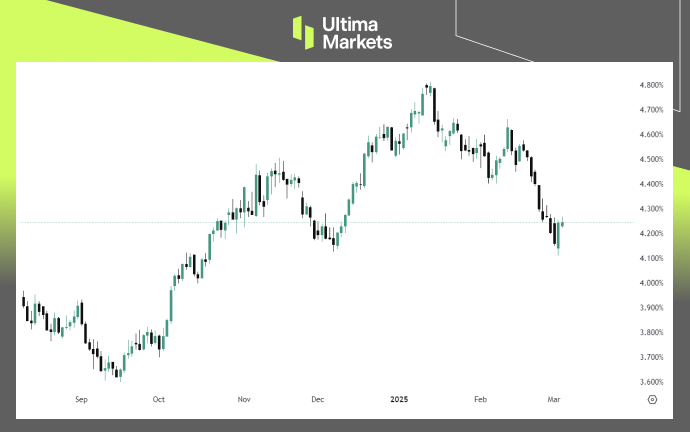

The U.S. dollar continued its decline for the second consecutive day on Tuesday, hitting a three-month low as worries over a “Trumpcession” grew. Safe-haven assets, such as U.S. Treasury bonds, saw increased demand, driving yields lower and reducing the appeal of dollar-denominated assets.

(US Government Bond 10-Year Yield; Source: Trading View)

Meanwhile, the euro climbed to its highest level in nearly four months, reaching around $1.0625. The British pound also strengthened, trading near a three-month high against the U.S. dollar.

Dollar’s Struggle Amid of Trumpcession?

As markets await Trump’s next move, focus may temporarily shifts to the upcoming February U.S. jobs report. Previous data showed a strong job market, leading to expectations that the Fed will maintain its current policy—typically supportive for the dollar.

If this week’s job data remains robust, the dollar could see a short-term rebound. However, this upside may be limited, as investors have largely priced in this scenario, making it difficult for the dollar to sustain further gains. Especially, Trump’s policies are likely to continue weighing on the U.S. dollar.

(2017-2018 Trend in US Dollar Index, Source: Trading View)

The depreciation of the US Dollar during Donald Trump’s first term was evident when he introduced aggressive policy measures, leading to a year-long decline from its decade-high levels.

Markets are now increasingly concerned that a “Trumpcession” could repeat, as more of his policy measures are set to be unveiled, potentially triggering another prolonged downturn in the dollar.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server