Gold received high demand in the market, buoyed by imminent rate cut from central banks around the world. The yellow bullion notched in positive gains this week as Federal Reserve, Bank of Canada and European Central Bank is expected to loosen their monetary policy in the coming months.

According to analysts, gold price is expected to set record high this year due to ongoing conflict in Middle East while coupled with lower interest rates. Likewise, traders flock into gold market over fears of US government debt which may worsen due to diminished economic momentum in the recent months.

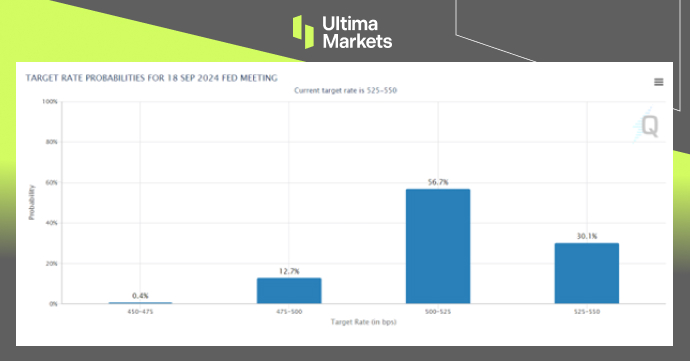

(CME FedWatch Tool, Chicago Mercantile Exchange)

In the meantime, investors are waiting for the release of Nonfarm Payrolls report due later tonight, which is expected to bring further clarification on the timing of rate cuts. Although the central bank is expected to keep interest rates unchanged next week, market is expecting a 69.8% chance for a rate cut by September.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server

Join the ultimate trading ecosystem

Ultima Markets is a member of The Financial Commission, an international independent body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis Towers Watson (WTW), a global insurance brokerage established in 1828, with claims eligibility up to US$1,000,000 per account.

Ultima Markets is the first CFD broker to be part of United Nations Global Compact.

RISK DISCLOSURE

Risk Warning: Trading Forex and CFDs carries the risk of losing substantially more than your initial investment and should only be traded with money you can afford to lose. You do not own or have any rights to the assets that underlying the derivatives (such as the right to receive dividend payments). Ensure you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please consider our legal documents and ensure that you fully understand the risks before you make any trading decisions.

General Advice Warning: The information on this website is a general nature only and any advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of any advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

Regional Restrictions:This information or devices on this website is not directed or offered to residents of certain jurisdictions such as the United States, North Korea etc. For more information, please contact our customer support team.

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission "FSC" of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Huaprime EU Ltd, registered number HE423188, and, with a business address at Georgiou Griva Digeni 122A, Kallinicos Court, Shop 1—Upper level, Neapolis, 3101 Limassol, Cyprus, is regulated by the Cyprus Securities and Exchange Commission, which has CIF license number 426/23.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

-

Messenger

Continue on Messenger

Take the conversation to your Messenger account. You can return anytime.

Scan the QR code and then send the message that appears in your Messenger.

Open Messenger on this device. -

Instagram

Continue on Instagram

Take the conversation to your Instagram account. You can return anytime.

Scan the QR code to open Instagram. Follow @ultima_markets to send a DM.

Open Instagram on this device. -

Live Chat

-