Market Quieting Ahead of Holiday

The U.S dollar fell a bit in thin pre-holiday trade on Thursday, digesting a slew of indicators that underlined U.S. economic resilience while investors assessed the risk that President-elect Donald Trump will start a tariff war that no one will win.

The decline further unwound the dollar’s recent rally. Few traders were interested in building or holding positions before a long Thanksgiving weekend for many of them that dovetails with month end. Markets are closed on Thursday and exchanges close early on Friday.

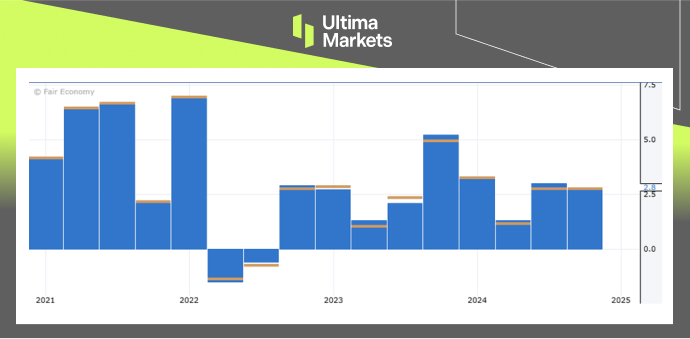

Also, revised data showing gross domestic product rose at a 2.8% rate in the third quarter, as expected and the same as last month’s first estimate, did not do much to bolster the case for the Federal Reserve to ease again next month, although traders still leaned that way, lifting odds a bit to 67%.

(U.S Prelim GDP q/q, Source: Forex Factory)

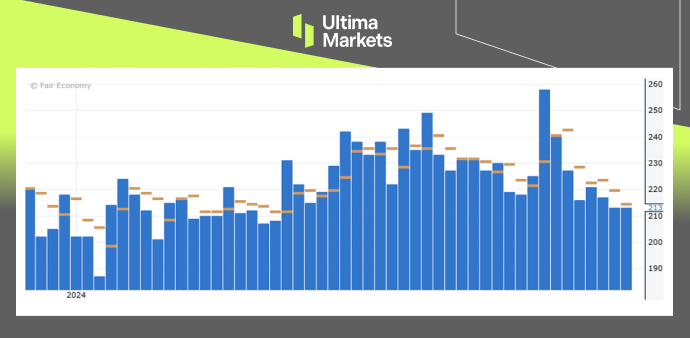

Neither did consumer spending data that showed progress on lowering inflation appears to have stalled in recent months while the economy retained much of its solid growth momentum early in the fourth quarter. While October durable goods orders rose a smaller-than-expected 0.2%, applications for unemployment benefits at 213,000 were a bit lower than last week’s upwardly revised 215,000 jobless claims, indicating a solid labor market.

(U.S Unemployment Claims, Source: Forex Factory)

The market generally expected that the inflation would pop up a little bit, but it is not getting out of hand. Therefore, this paves the way for a 25-basis point cut in December and then probably a pause. But the pause won’t likely be due to inflation data, but because of uncertainties over Trump’s tariffs.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server