You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

Korean Won Revived After Interventions by Korean Government

TOPICSTags: Bank of Korea (BOK), Forex market

Understanding the South Korean Currency Dynamics and Market Interventions

In the global financial landscape, the South Korean Won (KRW) has showcased a narrative of resilience and volatility in recent months, reflecting the intricate interplay of global economic forces and local regulatory interventions.

Let’s delve into the multifaceted factors contributing to the EBB and flow of the Won against the US dollar, examining how interventions and market movements have sculpted its trajectory.

Korean Won Revived in November

November witnessed a striking revival for the South Korean Won, marking a surge to approximately 1310 per USD, bouncing back from an 11-month low of 1356 in the previous month.

This resurgence owes itself to several factors, notably the perceptible weakening of the US dollar and a notable shift in the Federal Reserve’s stance towards a more dovish monetary policy. The termination of the rate-hike campaign from the Fed notably bolstered the Won’s value.

(USD/KRW One-year Chart)

Market Influence and Regulatory Actions

The Won’s resurgence was complemented by heightened foreign investment in the stock market, further underpinned by the decision of authorities to extend the ban on short selling until at least June of the following year.

However, despite these positive market movements, the year saw the Korean currency witnessing a 4% fall against the US dollar. This depreciation was propelled by multifaceted elements, including geopolitical risks, flight to safety, and a widening interest rate gap between South Korea and the US.

Market Intervention and the Central Bank’s Role

The Bank of Korea (BOK) played a pivotal role in curbing the Won’s depreciation, intervening in the forex market consistently throughout the year.

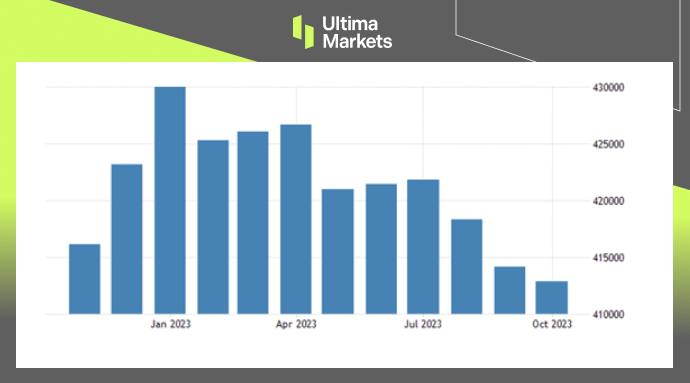

This proactive intervention led to a decline in foreign exchange reserves, which hit $412.87 billion in October, representing the lowest figures since June 2020.

Navigating Forex Reserves and Market Stability

South Korea’s foreign reserves faced a continuous decline, attributed to their utilization in stabilizing the foreign exchange market, a move sanctioned by the Bank of Korea.

By October’s closure, these reserves had diminished to $412.87 billion, showing a decrease of $1.24 billion from the prior month.

The breakdown of these reserves into various components like securities, deposits, special drawing rights, gold bullion, and IMF positions reflects a diverse strategy in safeguarding market stability.

Foreign Exchange Reserves Lowest in Over Three Years

South Korea’s foreign reserves fell for the third consecutive month as they were used to stabilize the foreign exchange market, according to the Bank of Korea (BOK). By the end of October, foreign currency reserves were $412.87 billion, down $1.24 billion from the previous month.

The reserves included $369.98 billion in securities, $18.87 billion in deposits, $14.77 billion in special drawing rights, $4.79 billion in gold bullion, and $4.45 billion in the IMF position.

South Korea remained the world’s ninth-largest holder of foreign reserves as of the end of September. Despite the declining trend, the central bank is not worried.

The BOK Governor Rhee Chang-yong said in late October that reserves have been stable since 2021 and increasing them further would come at a cost.

(Foreign Exchange Reserves, Bank of Korea)

Bottom Line

The South Korean currency’s trajectory reflects a dynamic interplay of global economic forces, market sentiments, and regulatory interventions.

As the authorities balance stability and growth, the resilience and adaptability of the Won against external pressures become increasingly evident.

Understanding this complex landscape is pivotal for stakeholders navigating the South Korean financial markets, highlighting the intricate balance between interventions and market dynamics.

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4