Focus on USD/JPY

On fundamentals, last Friday, BoJ revealed its monetary policy. The interest rate was unchanged as expected, however, the YCC curve surprised the market. Although BoJ has made a flexible adjustment on YCC, the targeted yield has not floated accordingly. The market describes BoJ as dovish and expects monetary easing policies to exist for some time in the future. In the short term, the yen is still in a depreciation trend while the market taking in the news.

On technical , the USD/JPY daily rebounded at the key support level last Friday, leaving a long lower shadow.

(USD/JPY daily, Ultima Markets MT4)

USD/JPY’s breaking the previous high before the interest rate decision implies a reverse move. Before it hits 144, the probability of extending the downward trend is relatively small.

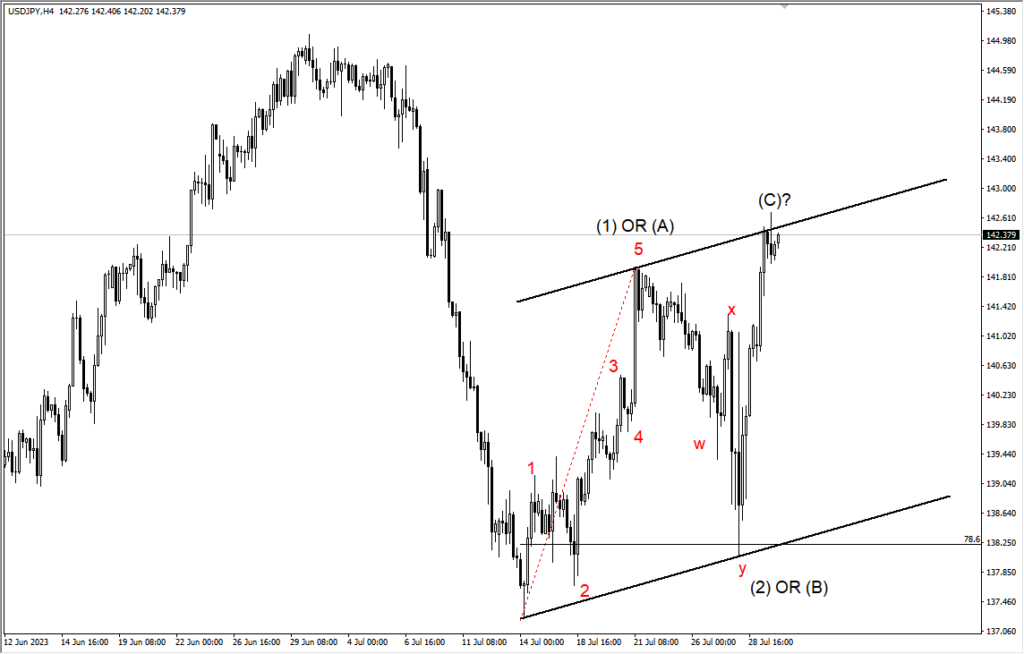

(USD/JPY in 4 -hour period, Ultima Markets MT4)

In 4-hour period, the exchange rate rises to the upper edge of the upward channel. In terms of wave structure, the 5th wave structure can be ensured. It is not yet confirmed that the long-term cycle has made a reversal twist.

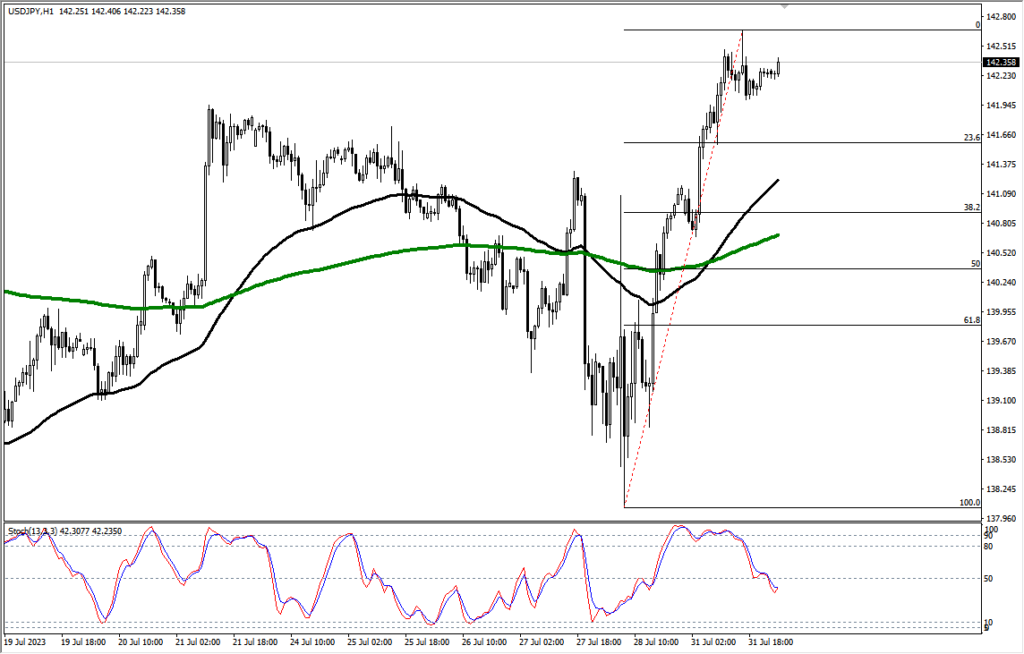

(USD/JPY in 1- hour period, Ultima Markets MT4)

In 1- hour cycle, the 65- week moving average often appeared as a support position in the trend. After the exchange rose and fell back yesterday, adjustment structure emerged. The Stochastic Oscillator was also in a weakening phase. It is expected to find support at the 65 -week moving average or the Fibonacci retracement position around 23.6%.

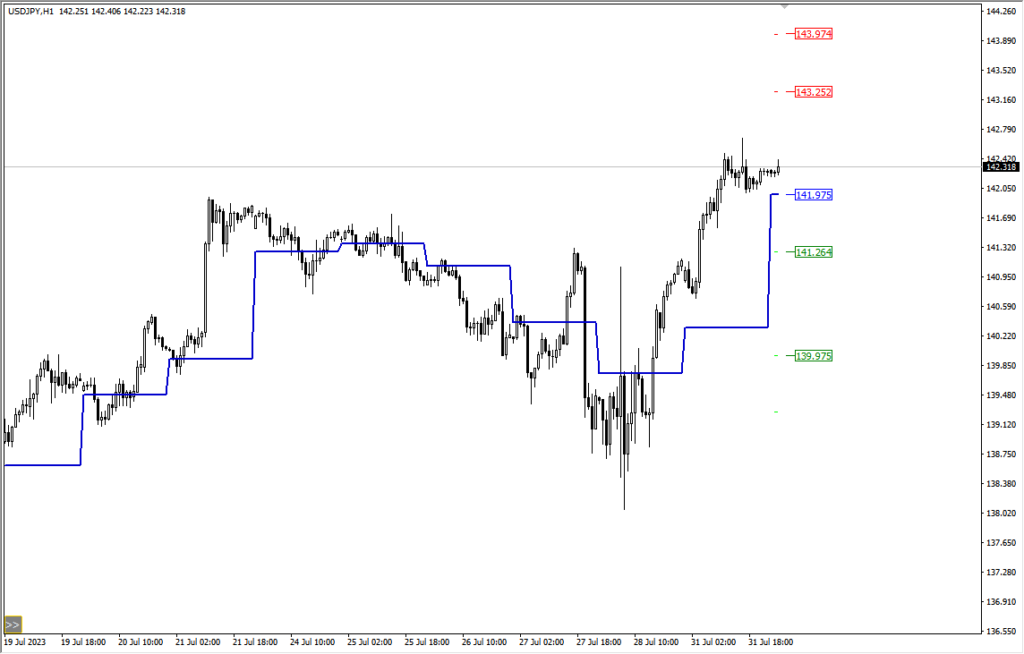

(USD/JPY in 1hr period, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price is 141.975,

Bullish above 141.975 is, the first target is 143.252, and the second target 143.974.

Bearish below 141.975, the first target is 141.264, and the second target 139.975.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server