Soft labor data and a dovish outlook for the Bank of Canada (BoC) halted the Canadian dollar’s rally. The loonie traded at 1.374 per USD, down from its August 9th strength of 1.37. Canada’s unemployment rate remained at 6.4%, its highest level in over two and a half years, despite being below market expectations. The labor market showed signs of softening as net employment unexpectedly fell for a second consecutive month, while the labor force participation rate dropped to its lowest since 1998, excluding pandemic-related shocks.

The Canadian dollar’s appeal has been further weakened by ongoing contraction in manufacturing and modest economic growth, increasing the likelihood of more easing by the BoC. In contrast, the Federal Reserve has not yet begun its rate-cutting cycle, with mixed expectations for an initial reduction in September.

(Unemployment Rate,Statistics Canada)

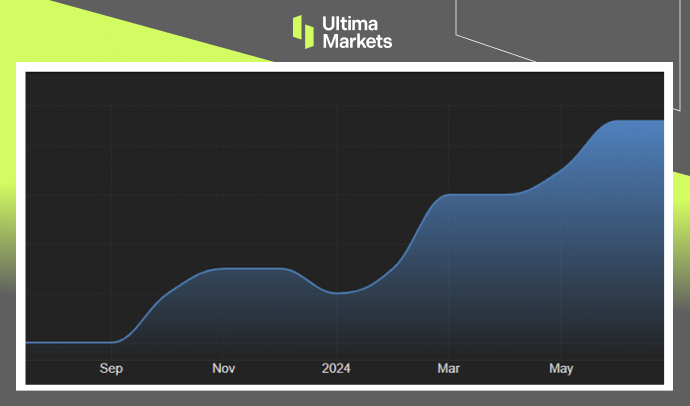

(USDCAD Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server