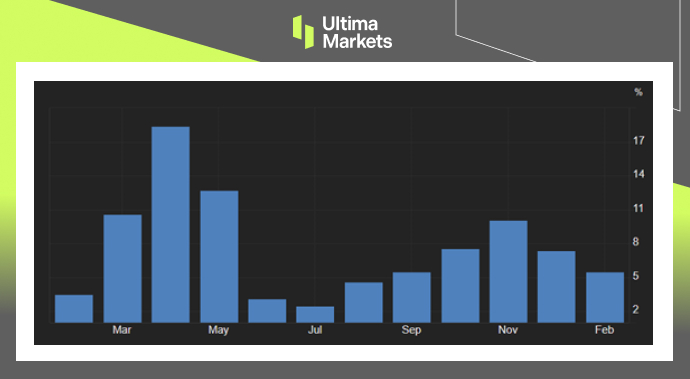

China’s retail sales saw a 5.5% year-on-year increase in the combined months of January and February 2024. This figure surpassed the market consensus of 5.2% and followed a 7.4% rise in December.

Retail trade experienced growth for the 13th consecutive month, with sales rising further for various categories such as grain and food oil (9.0% vs 5.8% in December), gold, silver, and jewelry (5.0% vs 29.4%), clothing (1.9% vs 26.0%), furniture (4.6% vs 2.3%), communications equipment (16.2% vs 11.0%), cars (8.7% vs 4.0%), and oil products (5.0% vs 8.6%). Additionally, sales rebounded for home appliances (5.7% vs -0.1%) and building materials (2.1% vs -7.5%).

However, trade continued to decline for personal care (-0.7% vs -5.9%) and office supplies (-8.8% vs -9.0%). The Chinese statistics agency publishes combined figures for the first two months of each year to smooth out distortions caused by the varying timing of the Lunar New Year.

(Retail Sales YoY%,National Bureau of Statistics of China)

The average urban unemployment rate in China, gathered from surveys, stood at 5.3% during the initial two months of 2024. A slight ascent was noted in February, with the unemployment rate reaching 5.3%, up from 5.2% in January and 5.1% in December of 2023.

This marked the highest level since July of the former year. The rate of unemployment for the locally registered workforce was 5.5%, and was 4.8% for migrant workers. The rate of joblessness in 31 principal cities and towns was 5.1%. Enterprise employees clocked in an average of 48.0 working hours weekly.

For 2024, China’s government has set a prospective target of 5.5% for unemployment rate, with the goal of generating around 12 million new urban employment opportunities. The GDP growth target for China in 2024 is estimated to be approximately 5%.

(Unemployment Rate,National Bureau of Statistics of China)

The offshore yuan weakened past 7.2 per dollar, hitting its lowest levels in over a week as investors reacted to the latest batch of economic reports. The yuan continued to face challenges due to the unexpectedly robust US inflation data, which added uncertainty to the schedule and extent of interest rate reductions by the Federal Reserve this year.

Increased consumer and producer prices in the US, exceeding expectations in February, led traders to diminish expectations for a rate cut by the US central bank in June. The expanding rate differentials also put additional strain on the yuan as US bond yields recovered, while Chinese yields lingered close to all-time lows.

(USDCNY Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server