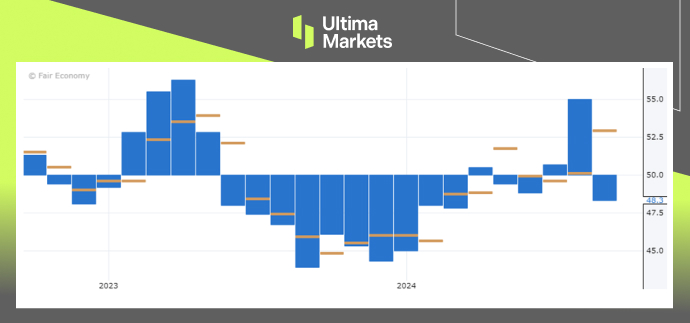

On Monday, the Euro took a sharp hit following disappointing business activity data from the eurozone. France’s flash services PMI came in at 48.3, significantly below the expected 53.0, while Germany’s flash services PMI was reported at 50.6, falling short of the forecast of 51.1.

(French Flash Services PMI, Source: Forex Factory)

(German Flash Services PMI, Source: Forex Factory)

The eurozone’s business activity saw a steep contraction this month, as its dominant services sector stalled, and the manufacturing downturn intensified. The contraction was widespread, with Germany’s decline worsening and France slipping back into contraction after a temporary boost in August, driven by the Olympic Games. While a reversal from the Paris Olympics was anticipated, the data was far worse than expected, painting a rather bleak outlook for eurozone growth.

As a result, the weak data reinforced market expectations for further rate cuts by the European Central Bank this year. Currently, there is a roughly 77% probability of a 25-basis point (bps) cut at the ECB’s October meeting. The ECB has already cut rates in both June and earlier this month, and market participants are closely watching for its next move. Additionally, France plans to submit its public debt reduction proposal to the European Commission by the end of October, ahead of the previously expected deadline.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server