Eurozone Inflation Cools, Markets Eye ECB’s Next Move

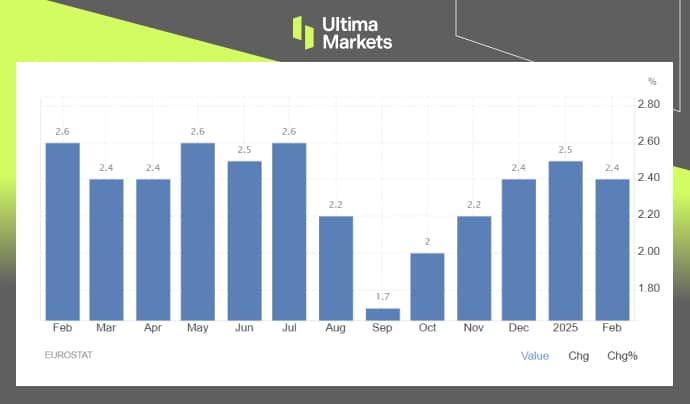

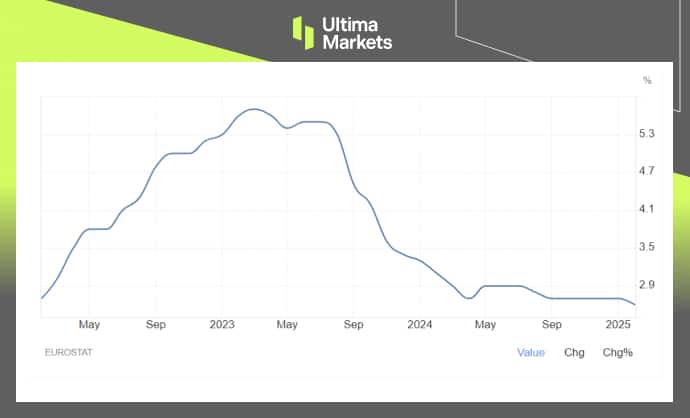

The Eurozone Harmonized Consumer Price Index (HICP) for February came in slightly lower than the expected 2.5%, easing to 2.4% from 2.5% in January. Meanwhile, the Core Consumer Price Index, which excludes volatile energy, food, alcohol, and tobacco prices, declined to 2.6% from 2.7% in January, marking its lowest level since January 2022.

(Euro Zone Inflation Rate; Source: Trading Economics)

(Euro Zone Core Inflation Rate: Source; Trading Economics)

The decline in annual inflation is largely attributed to energy costs, which rose by only 0.2% in February—a significant slowdown from the 1.9% increase in January. This trend aligns with the European Central Bank’s (ECB) target of maintaining inflation close to 2%.

Market Implications for ECB Monetary Policy

The moderation in inflation reinforces expectations that the ECB may cut interest rates by a quarter point to 2.5% in Thursday’s meeting, aiming to boost economic growth by lowering borrowing costs.

While a cut is widely expected, ECB policymakers remain divided on the pace and extent of further easing. Despite sluggish eurozone growth, uncertainties like potential U.S. tariffs, political instability in France and Germany, and the Ukraine crisis complicate the ECB’s decision-making.

Some ECB officials warn that excessive cuts could destabilize the economy, urging caution. This leaves markets speculating whether the ECB will opt for a dovish or hawkish cut in March.

ECB March Meeting: A Hawkish Cut?

Following the release of Euro Area CPI data, the euro strengthened against major currencies, including the US dollar. This is largely due to market expectations of a hawkish cut from the ECB in its March meeting.

With inflation aligning with the ECB’s 2% target, policymakers may adopt a more cautious approach to easing after the March cut, as there is no urgent need for further rate reductions, especially amid ongoing economic uncertainties.

(EURUSD, 4-H Chart Analysis; Source: Trading View)

EUR/USD surged to its key resistance at 1.0500 again after the Euro CPI release. While the ECB repricing has strengthened the euro, it still faces resistance near 1.0500.

From a technical perspective, EUR/USD may continue to consolidate below 1.0500 as the market lacks a strong bullish catalyst for the euro.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server