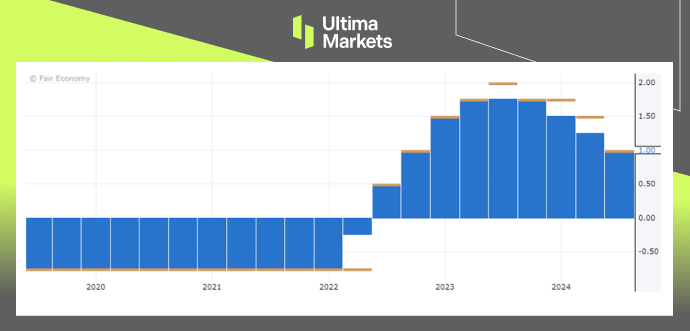

Swiss National Bank Cut 25 Basis Point as Expectation

TOPICSOn Thursday, the Swiss National Bank reduced interest rates by 25 basis points to 1.00%, marking the lowest level since early 2023. The cut was the bank’s third such reduction this year as the central bank dialled back measures designed to combat inflation. This echoed step taken to lower borrowing costs by the European Central Bank and the U.S. Federal Reserve, and it left the door wide open for more rate cuts as inflation cools sharply.

(Swiss National Bank Policy Rate, Source: Forex Factory)

The decision, the last in the 12-year tenure of SNB Chairman Thomas Jordan, was enabled by the taming of price rises in Switzerland, which slowed to 1.1% in August and have been within the central bank’s 0-2% target range for the last 15 months. The SNB is ready to cut interest rates again, Jordan said after the decision, noting that inflationary pressure in Switzerland had decreased significantly.

His successor, Martin Schlegel, said the SNB’s view that inflation was likely to fall further meant additional cuts were possible, although he did not provide any guarantees. Schlegel noted that the decision to cut rates again was helped by weaker inflationary pressure in Switzerland, with the SNB slashing its inflation forecasts for 2025 and 2026 and predicting consumer price growth of 0.6% in the second quarter of 2027.

“Our mandate is price stability, and this will remain our mandate”, Schlegel told Reuters in an interview on Thursday, as this is also our priority at the Swiss National Bank. Price stability is defined as inflation within a range of 0-2%, which has been a key target for Jordan during his leadership, and it has been achieved over the last 15 months as the SNB hiked interest rates and allowed the appreciation of the Swiss franc to keep the price of imports in check.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server