Housing Inventory Gains Drive Market Shift

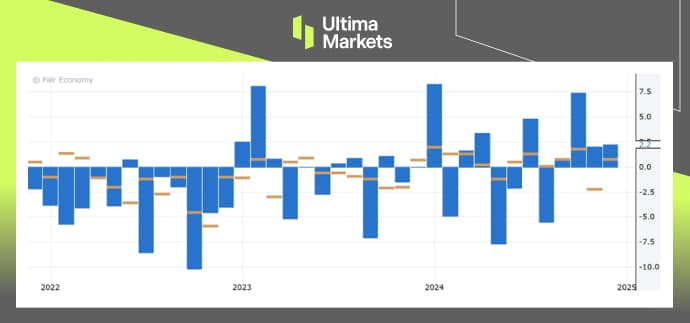

On Monday, measures of US pending home sales according to signed contracts increased by 2.2% in November standing at 79.0. This was the highest level of US pending home sales since February 2023 and it is better than the recorded 77.3 for the month of October. Sales of contracts for the purchase of previously owned houses exceeded expectations and this is a good development as the increase marks the fourth month in a row. As a result, the U.S. dollar strengthened by 0.26%, resulting in an increase in the index to 108.355.

(U.S Pending Home Sales m/m Chart, Source: National Association of Realtors)

(U.S Dollar Index Chart, Source: Trading View)

The increase in contract signing in November, was consistent with the NAR’s reporting of the second consecutive month in which the number of completed home purchases rose, so why did the report less June than I expected. NAR noted in the report that, in November, the number of homes for sale was up almost 18% compared to the same month last year.

It looks like consumers have changed their expectations regarding the mortgage rates and acted on the supply of more existing inventories. Given that mortgage rates have been hovering over 6% for 2 years now, buyers are no longer expecting any dramatic decreases in rates but are taking advantage of the market shift from a seller’s market to a more negotiable one. In contrast, the 10-year U.S. Treasury yield, which is one of the key factors affecting the rates of home loans has increased since September by about 1 percentage point.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server