US Dollar Slips After Lower Job Revision, Strengthen Fed Dovish Tone

TOPICSTags: FED, Job Revision, US dollar

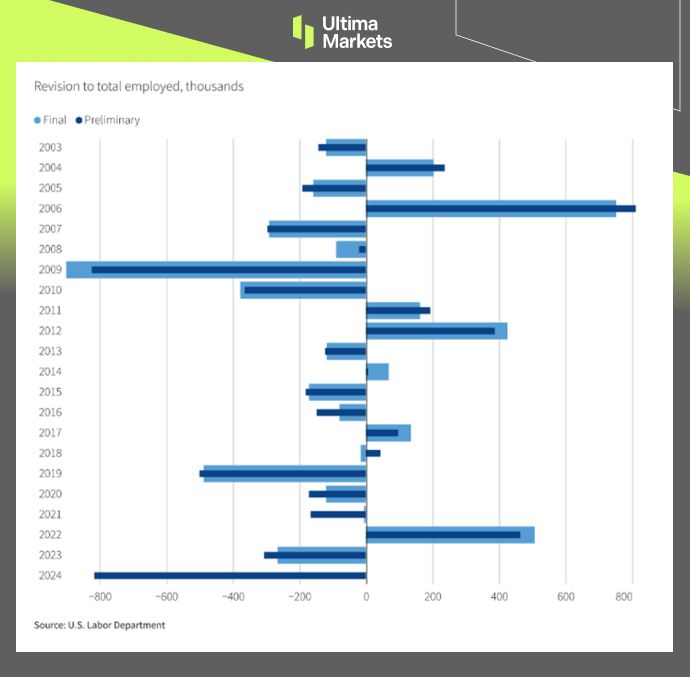

On Wednesday, the US dollar index declined by 0.24%, closing at 101.14, marking its lowest level this year. This drop was largely attributed to revised data revealing that employers added 818,000 fewer jobs in the year through March than previously estimated.

(2024 Preliminary Benchmark Payroll Revision)

The Fed now faces fewer obstacles to cutting rates through year-end, though the jobs data doesn’t strongly justify a 50-basis point cut. However, prolonged weakness in employment market while coupled with rising unemployment may push Federal Reserve to cut rates more aggressively to circumvent impending recession.

The employment and inflation report for August will be released after Powell’s speech but ahead of the September meeting. Currently, traders are pricing in a 38% chance of a 50-basis point cut next month, up from 33% earlier on Wednesday, and a 62% probability of a 25-basis point cut, according to the CME Group’s FedWatch Tool.

Powell is set to deliver the keynote address in Jackson Hole on Friday, and markets are eagerly awaiting clues about the potential size of next month’s cut and whether further reductions in borrowing costs could follow in subsequent policy meetings.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server