US March Inflation Eases, Dollar Index on Multi-year Lows

TOPICSThe latest US Consumer Price Index released on April 10th showed the US inflation has shown signs of easing inflation with the inflation marking a first decreasing in 2025.

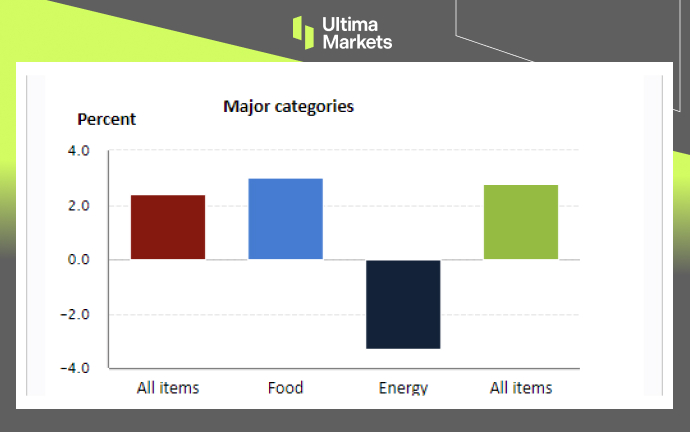

The headline Consumer Price Index rose by 2.4% year-on-year, marking a slowing trend in price increases, while Core CPI—excluding volatile food and energy prices—climbed 2.8%. This is the lowest annual core inflation rate in four years. Both the inflation figure marked the most encouraging reading since September 2024.

(March Consumer Price Index YoY; Source: US Bureau of Labor Statistics)

After the release, the U.S. Dollar extended its decline in response to the report, as markets interpreted the data as strengthening the case for a rate cut by the Federal Reserve in June 2025

According to the CME FedWatch Tool, markets now see a probabilities of 3–4 rate cuts in 2025, up from previous expectations of just two.

The greenback’s decline suggests investor optimism on a more dovish stance by the Federal Reserve, driven by expectations of continued disinflation.

Fed Outlook: Remain Cautious on Tariff Risks

However, despite signs of easing inflation, the Federal Reserve remains cautious, warning that recent tariff adjustments under President Trump’s policy could introduce inflationary pressures that might undo the progress made in reducing price growth.

This concern has been echoed by multiple Federal Reserve officials in their speeches this week.

- Lorie Logan, President of the Dallas Federal Reserve, pointed out the significant risk posed by tariffs. She warned that tariff-induced price hikes could lead to persistent inflationary pressures, undermining the disinflation trend observed in March’s CPI.

- Austan Goolsbee, President of the Chicago Federal Reserve, reiterated that while rate cuts remain a possibility in the near future, the prevailing risks—especially from elevated tariffs—could trigger stagflationary conditions.

From recent Fed officials tone, the Fed’s approach would likely to remain cautious and data-driven, closely monitoring both inflationary trends and the broader economic impact of trade policies.

Dollar Struggle Amid Uncertainty & Cuts Bets

The U.S. Dollar Index (DXY) extended its multi-year decline following the CPI data release, as markets responded to the disinflation trend and the rising probability of rate cuts.

The dollar’s softness also comes amid growing concerns about the impact of Trump’s tariff policies on the broader economy.

(USDX, Dollar Index, Day Chart; Source: Ultima Market MT5)

The US Dollar extend downside to its multi-year low, losing ground on 100.00 psychological level on the Friday’s Asian session.

While, the technical rebound could potentially seen, the broad trend in US Dollar remain downside, given that the current economic landscape and policy may continue to weigh on the US Dollar.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server