Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

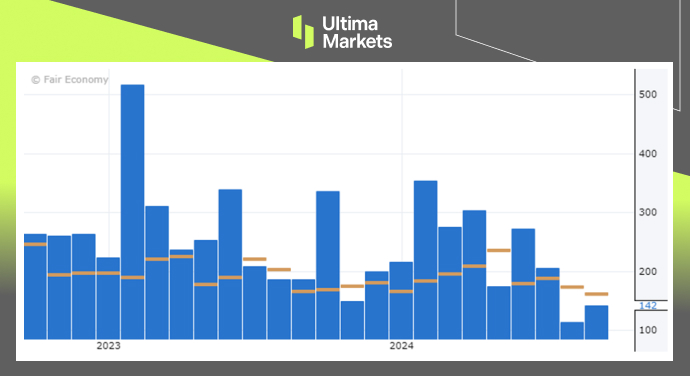

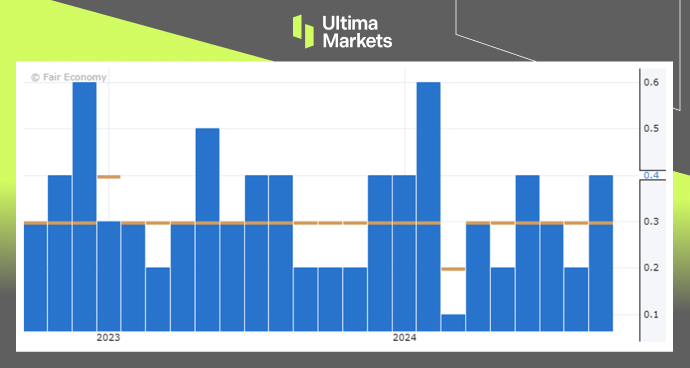

The Dollar Index, which tracks the U.S. currency’s performance against six major counterparts, rose 0.2% to 101.21. It climbed amid volatile trading on Friday after data revealed U.S. employment grew less than anticipated in August, pointing to a gradual slowdown in the labour market. Non-farm payrolls increased by 142,000 last month, following a downwardly revised rise of 89,000 in July, falling short of the forecasted 164,000 jobs. While the average hourly earnings m/m increased by 0.4%, stronger than the expectation of 0.3%, therefore providing a mixed data.

(U.S Non-Farm Employment Change Graph, Source: Forex Factory)

(U.S Average Hourly Earnings m/m, Source: Forex Factory)

Although the dollar initially declined against most major currencies after the release of the jobs data, it quickly rebounded to trade higher. This reaction is due to market uncertainty, as the data is balanced in such a way that it could support arguments for either a 25 or 50 basis point rate cut. According to LSEG data, traders now estimate a 31% chance that the Federal Reserve will reduce its policy rate from the current 5.25% to 5.50% range to 4.75% to 5% at the September 17-18 meeting.

While a half-point rate cut in September remains unlikely, the data released highlighted a clear weakening of labor market fundamentals, boosting expectations of at least one significant rate cut in the coming months. Moreover, Federal Reserve officials indicated on Friday that they are prepared to initiate a series of rate cuts at the upcoming meeting, pointing to a softening labor market that could worsen without policy adjustments.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server