Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Top 10 IC Design Houses Recorded Revenue Up 12.5% QOQ, And Growth Is Expected To Extend In 3Q23

TOPICSThe Rise of NVIDIA: A Dominant Force in IC Design

In the fast-paced world of integrated circuit (IC) design, the tides are constantly shifting, and the recent performance of the industry’s top players has been nothing short of remarkable.

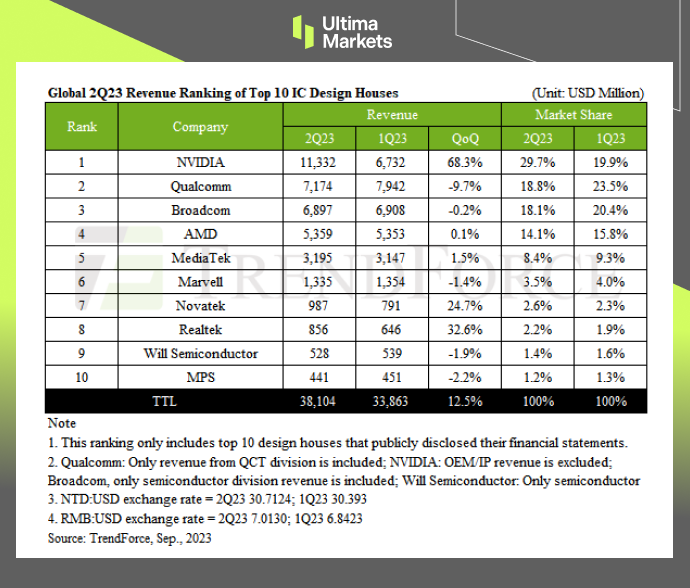

According to TrendForce reports, fueled by an AI-driven inventory stocking frenzy across the supply chain, 2Q23 revenue for the top 10 global IC design powerhouses soared to US $38.1 billion, marking a 12.5% quarterly increase.

In this rising tide, NVIDIA seized the crown, officially dethroning Qualcomm as the world’s premier IC design house, while the remainder of the leaderboard remained stable.

(2Q23 World’s top 10 IC design houses, TrendForce)

NVIDIA: The New Kingpin

NVIDIA benefited from global CSPs (cloud service providers), internet company and enterprise generative AI, large-scale language model import application demands, and its data center revenue increased by as much as 105% quarterly.

In addition, revenue from gaming and professional visualization businesses also continued to grow, driven by new products.

Overall, revenue in the second quarter reached US$11.33 billion, a quarterly increase of 68.3%.

Qualcomm’s Challenges

Qualcomm’s Q2 took a hit as the Android smartphone sector grappled with dwindling demand and Apple’s modem pre-purchases resulted in a subdued seasonal rhythm.

Consequently, their revenue slid by 9.7%, rounding off at about US$7.17 billion.

Broadcom’s Mixed Bag

Broadcom benefited from the sales of high-end switches and routers catalyzed by generative AI, its NetCom business increased by about 9% quarterly.

However, offset by the decline in server storage, broadband, and wireless business, the second quarter revenue was roughly the same as the previous quarter at about $6.9 billion.

AMD’s Steady Stance

AMD’s overall second-quarter revenue was roughly the same as the previous quarter at about US$5.36 billion, due to the decline in gaming GPU sales and embedded business in the second quarter.

The Outlook for IC Design Houses

Although the inventory levels of semi-companies have improved significantly compared with those in 1H23, the outlook for the second half of the year tends to be conservative because of the weak market demand.

It is worth noting that the wave of generative AI and large-scale language model deployment has emerged among Internet companies and private enterprises.

It is expected that AI will be more helpful to related supply chain operations in the second half of the year, and the average sales unit price of such products will be higher than that of consumer products.

As a result, the world’s top ten IC design revenue will continue to have double-digit quarterly growth in the third quarter, and the output value is expected to reach a new high.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4