You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

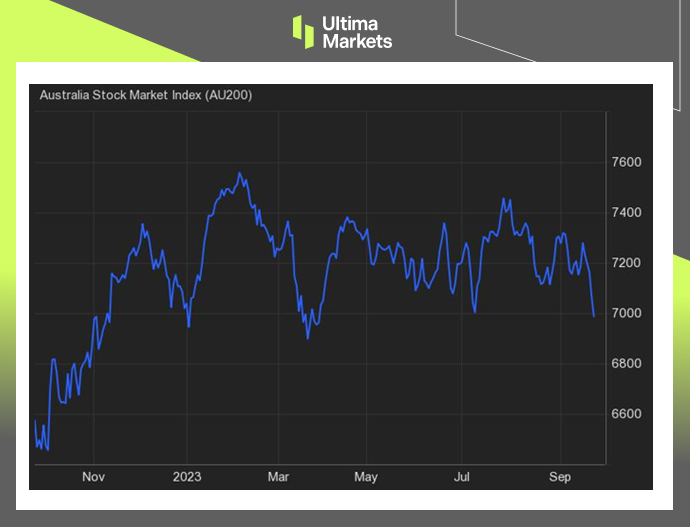

Main Point: ASX 200 Index’s Recent Decline

The ASX 200 Index tumbled 1.3% to below 7,000 on Sep. 22, hitting its lowest levels in six months and tracking losses on Wall Street overnight as the US Federal Reserve’s hawkish pause continued to weigh on investor sentiment.

The benchmark index is also on track to lose nearly 5% this week for its second consecutive weekly decline. Domestically, investors digested data showing Australia’s manufacturing activity contracted further in September, while services activity turned expansionary.

Impact on Key Sectors

Commodity-linked stocks led the decline with sharp losses from BHP Group (-2%), Rio Tinto (-2.3%), Fortescue Metals (-2.2%), Woodside Energy (-0.9%) and Newcrest Mining (-0.9%). Heavyweight financial, technology, and consumer-related firms slumped as well.

(ASX 200 Index daily chart)

The Judo Bank Flash Australia Manufacturing PMI

The Judo Bank Flash Australia Manufacturing PMI fell to 48.2 in September 2023, from 49.6 in the previous month, flash estimates showed. It pointed to the lowest reading in 4 months, indicating continued deteriorating business conditions across the sector.

Inflation and Pricing Strategies

A sharper fall in new orders led to manufacturing output shrinking for a tenth straight month in September. Consequently, firms reduced their purchasing activity and inventory holdings.

That said, employment levels rose with some manufacturers still facing a shortage of labor to support ongoing operations. Staffing constraints also led to a marginal lengthening of lead times.

Input cost inflation eased amid the drop in purchasing activity, while firms also raised their own selling prices at a slower rate.

(Judo Bank Australia Manufacturing PMI, S&P Global)

Implications and Conclusion

In conclusion, the ASX 200 Index’s recent nosedive results from a complex interplay of domestic and international factors.

The US Federal Reserve’s hawkish stance, along with domestic issues, especially the manufacturing sector’s contraction, has deepened economic uncertainties.

While challenges persist, businesses have demonstrated resilience in adapting to the evolving landscape.

In this volatile market, comprehending the intricacies of the ASX 200 Index’s journey is vital for investors and analysts alike.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4