Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Bank of Canada Cuts Rates by 25bps as Expected

TOPICSTags: Bank of Canada, Cut Rates, Inflation, Tiff Macklem

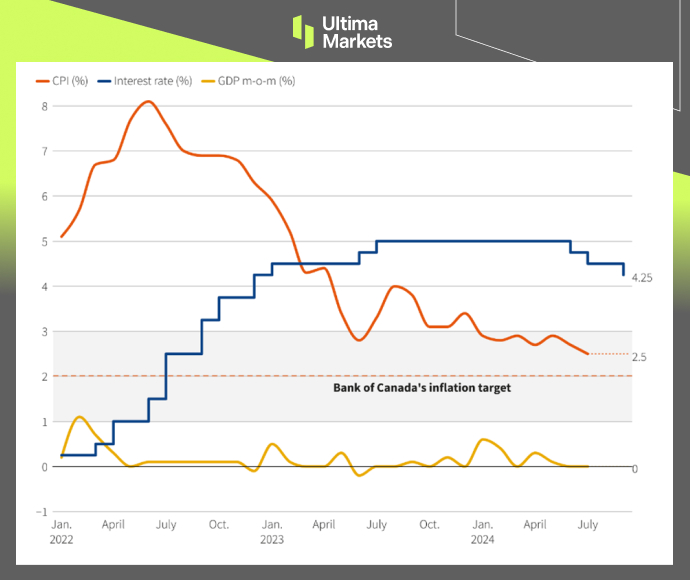

On Wednesday, the Bank of Canada reduced its key policy rate by 25 basis points to 4.25%, in line with expectations. Governor Tiff Macklem noted that due to sluggish economic growth, a larger rate cut might be necessary to support the economy.

The central bank had maintained its benchmark rate at a two-decade high of 5% for a year, before initiating an easing cycle in June. Wednesday’s move marked the third consecutive rate cut, with the bank pointing to further easing in inflationary pressures.

Inflation dropped to a 40-month low of 2.5% in July, though it remains above the BoC’s 2.0% target. However, the economy is now performing below the bank’s forecast from just six weeks ago.

(Graph of CPI, Interest Rate and GDP, Source: Bank of Canada)

This weakening economic outlook has strained the country’s ability to accommodate a rapidly growing workforce, leading to higher unemployment and increasing pressure for continued rate cuts. Some economists suggest that slower growth could push the bank toward a larger 50 basis point rate cut in October or December. Macklem also acknowledged the possibility of a bigger cut if economic conditions deteriorate further.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server