You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Bank of England Poised to Await Opportune Moment for Initial Rate Cut

TOPICSTags: Bank Of England, Inflation, United Kingdom

Brexit used to dominate the news headlines. By the end of January 2020, the UK formally parted ways with the EU. This, combined with a shift in the Bank of England’s leadership, the outbreak of the COVID-19 pandemic, and global inflation challenges have all fueled uncertainty for the economy’s future. Will the UK manage to circumvent a severe downturn and sidestep the menacing specter of inflation? Given the anticipation of a rate cut in the market, what will be the Bank of England’s strategy?

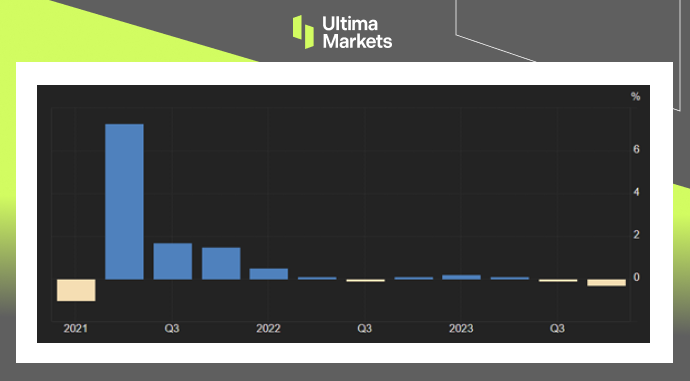

We will examine several critical indicators that might help us find hints and understand the situation better. The Gross Domestic Product (GDP) of Britain decreased by a negligible amount of 0.3% in the last quarter of the previous year. This decrease marked the second straight quarter of contraction, pushing the nation into a state defined as a technical recession. The rate of growth of the GDP was extremely slow, sitting at a barely noticeable 0.1% increase in 2023.

The British economy has found itself in a lethargic state since the onset of the pandemic, struggling to regain its previous vitality. This struggle was further compounded in recent years due to a significant surge in the inflation rates, triggered by the warfare between Russia and Ukraine.

British Finance Minister, Jeremy Hunt, also drew attention to this issue. He candidly identified high inflation as the largest and most substantial impediment to the nation’s economic growth. He advocated for focused efforts towards tackling this issue as a mitigation strategy to pave the way for a stable and thriving economy.

(United Kingdom GDP Growth Rate, %)

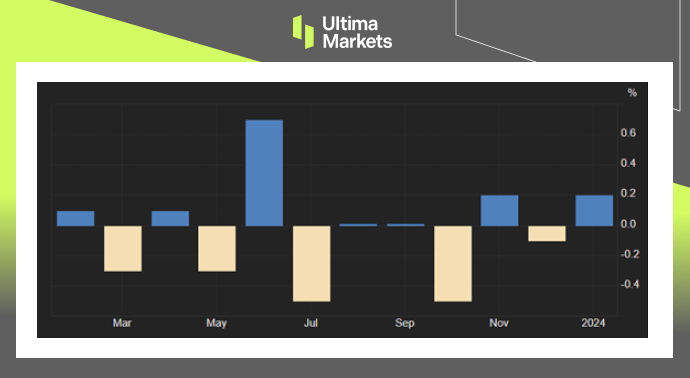

There’s certainly reason for cheer as the economy of Britain showed signs of revival at the dawn of 2024. The welcomed development brought much-needed relief to Prime Minister Rishi Sunak, who is bracing for an anticipated election to be held later this year.

Shedding light on the details, the UK’s Gross Domestic Product (GDP) recorded an increase of 0.2% on a month-to-month basis in January 2024. The notable rise came after a slight dip of 0.1% in the prior month of December. Central to this economic recovery were the retail and housing construction sectors, both of which exhibited a vigorous rebound.

(United Kingdom Monthly GDP MoM, %)

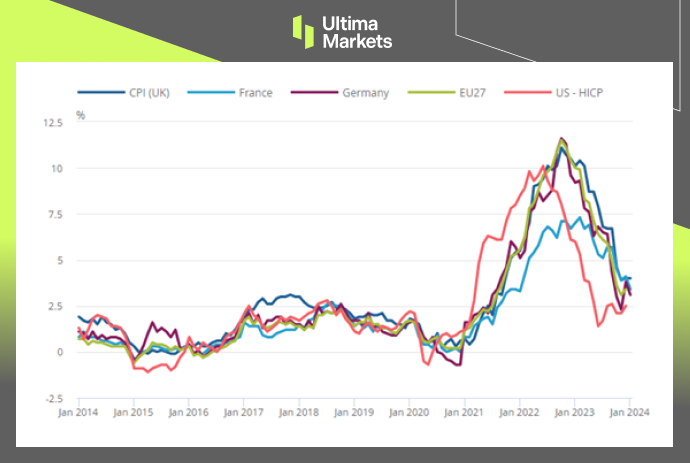

Focusing on the matter of inflation, the United Kingdom’s inflation rate remained stable at 4.0% in January 2024, echoing the two-year low from November while undershooting the projected market expectation of 4.2%. Regardless, it sustained at a level double that of the Bank of England’s 2.0% target. Comparatively speaking, the UK’s inflation is strikingly high when pitted against other European nations. Examining statistics from February 2024, Germany’s yearly inflation dipped to 2.5%, France’s reduced to 3.0%, and the Euro Area’s annual inflation recorded a decline, moving from 2.8 % in January 2024 to 2.6 %.

(United Kingdom Inflation Rate, %)

(UK inflation is above that of France, Germany, and EU)

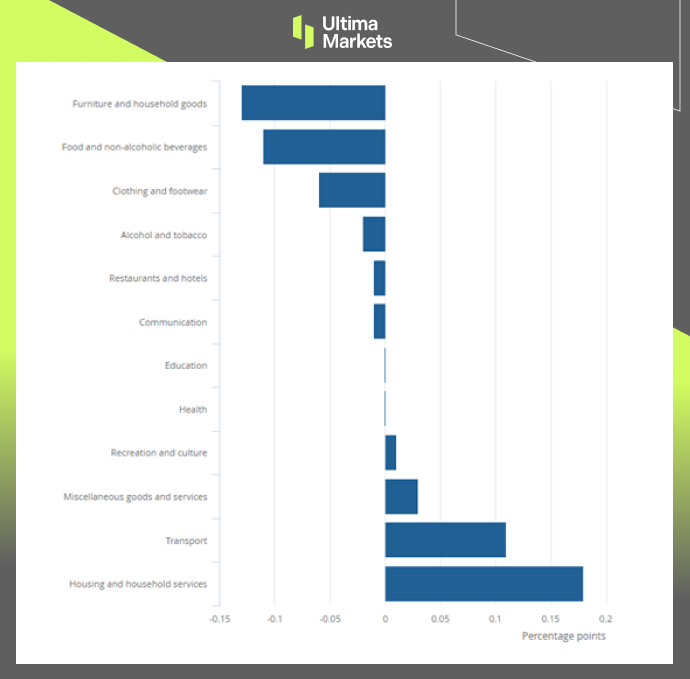

Upon examining more closely, it was observed that the rate of price drops for housing and utilities, and transport experienced a deceleration, attributed to gas and electricity costs (-2.1% compared to -3.4% in December for housing and utilities, and -0.3% compared to -1.1% for transport). Conversely, the inflation rate for furniture and household items, and food and non-alcoholic beverages had a notable decrease (0.4% compared to 2.5% for furniture and household items, and 6.9% compared to 8.0% for food and non-alcoholic beverages). The only category that witnessed an increase in inflation was miscellaneous goods and services (4.5% compared to 4.3%). In the meantime, the yearly core inflation rate, which omits fluctuating aspects like energy and food, remained consistent at 5.1%, which is marginally less than the market prediction of 5.2%.

The cost of transportation is inextricably linked to fluctuations in oil prices, as fuel represents a significant expenditure for both personal vehicles and commercial logistics operations. Since the beginning of 2024, the global benchmark Brent crude has experienced a resurgence, its price escalating from $76 to $87 per barrel. This upward trajectory in oil prices exerts upward pressure on overall inflation levels.

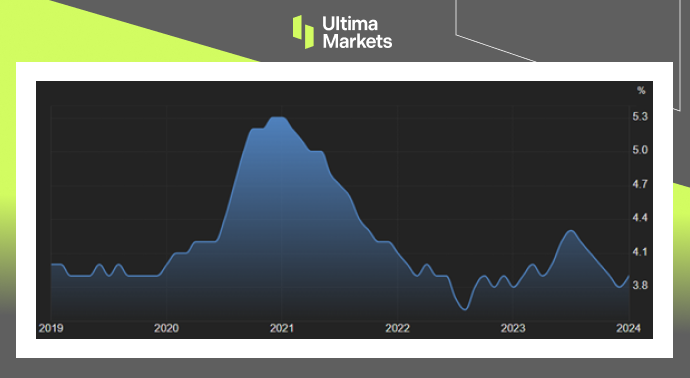

Moreover, the stubborn persistence of elevated service prices poses a formidable challenge to efforts aimed at reining inflation. The labor market remains exceptionally tight, with the unemployment rate lingering at the historically low level of 3.9%. In such an environment, businesses face intense competition for workers, often compelling them to offer higher wages and more generous compensation packages, which in turn translates into higher consumer prices for services.

Andrew Bailey, the Governor of the Bank of England, has granted an inflation-beating pay rise to the Bank’s staff, despite repeatedly advising workers not to demand substantial wage increases. This move has upset the general public, as it contradicts Bailey’s stance on wage growth. In the UK, annual growth in regular earnings, excluding bonuses, stood at 6.1%, while annual growth in employees’ average total earnings, including bonuses, was 5.6%. Both rates are steadily higher than the country’s inflation rate.

The housing sector adds another layer of complexity to the inflation conundrum. Residential costs, encompassing rent and mortgage payments, have proven remarkably resilient, resisting downward pressures. This stickiness in housing expenditures contributes to the overall inertia of inflation, making it increasingly arduous to achieve a sustained deceleration in the rate of price growth across the broader economy.

(Contributions to change in the annual CPI inflation rate, UK, between December 2023 and January 2024)

(United Kingdom Unemployment Rate, %)

Recently, the UK government implemented a financial strategy that will result in a yearly tax reduction benefiting 27 million citizens, translating to several hundred pounds per person. Households with two median income earners could see savings of nearly £1,000 annually.

In addition, British Premier Rishi Sunak indicated that the possible period for the next general election could be the latter half of this year. While legally the next election can occur up until January 2025, opposition parties have been voicing their desire for an earlier election amidst recent conjecture about the event’s scheduling.

The fight against inflation is not yet over in the UK, and to reach the final hurdle of their target an extended duration of restrictive interest rates is necessary. The Bank of England is looking to maintain a balance of policies as the central government undergoes notable change. The existing fiscal strategy is creating a buffer, allowing for maneuvers in the monetary space. The anticipated rate cut is predicted to occur much later in the year, after the European Central Bank’s (ECB) decisions.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server