You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Lululemon Q3 Earnings: Surpassing Expectations and Looking Ahead

Lululemon Athletica Inc. (LULU) recently released its third-quarter results, exceeding expectations and showcasing robust international growth. In this article, we delve into the key financial highlights, the company’s performance, and its outlook for the fourth quarter.

Lululemon Q3 Financial Highlights

Lululemon’s Q3 adjusted earnings per share stood at $2.53, surpassing Wall Street forecasts of $2.28. The total revenue for the quarter reached $2.2 billion, slightly exceeding the predicted $2.19 billion.

The company experienced significant international expansion, with a remarkable 49% spike in international revenue. Additionally, North American sales saw a noteworthy increase of 12% during the same period.

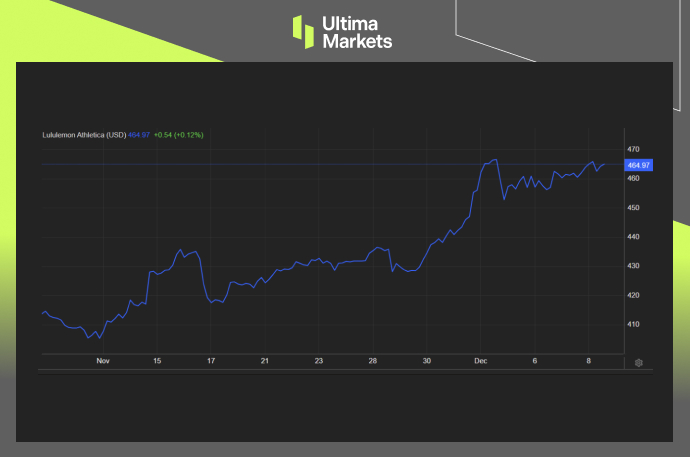

(Lululemon Stock Performance One-month Chart)

Expansion and Store Openings

During the third quarter, Lululemon continued its global expansion by opening 14 new stores, expanding its total footprint to 686 locations globally. This growth underscores the brand’s commitment to reaching and serving a wider audience.

Lululemon Q4 Outlook

Looking ahead to the fourth quarter, Lululemon anticipates earnings growth of up to 12%, projecting earnings per share in the range of $4.85 to $4.93. The revenue forecast for Q4 is estimated to be between $3.135 billion and $3.17 billion, reflecting a 13-14% increase. However, these projections fell slightly short of analysts’ estimates, which anticipated $4.94 per share on $3.18 billion in revenue.

Full-Year Outlook and Revision

Lululemon has revised its full-year revenue forecast to be between $9.55 billion and $9.58 billion. This upward revision from the previous range of $9.51 billion to $9.57 billion demonstrates the company’s confidence in its growth trajectory. Adjusted earnings are also expected to rise by up to 23%, with a projected range of $12.34 to $12.42 per share.

Lululemon Stock Performance

Explore Lululemon’s current stock performance with this one-month chart, providing historical stock charts, analyst ratings, and real-time stock prices.

CEO Calvin McDonald’s Leadership

Learn more about the leadership behind Lululemon by visiting this insightful profile on Financial Times.

Market Analysis and Comparative Data

For a comprehensive market analysis and comparative data, visit Barron’s, offering insights into day range, 52-week range, volume, market value, and EPS (TTM).

Frequently Asked Questions

Q1: How did Lululemon perform in the third quarter of 2023?

A1: Lululemon’s Q3 results exceeded expectations, with adjusted earnings per share of $2.53 and total revenue reaching $2.2 billion.

Q2: What is Lululemon’s outlook for the fourth quarter?

A2: Lululemon anticipates earnings growth of up to 12%, projecting earnings per share in the range of $4.85 to $4.93 and revenue between $3.135 billion and $3.17 billion.

Q3: How has Lululemon revised its full-year forecast?

A3: Lululemon has revised its full-year revenue forecast to be between $9.55 billion and $9.58 billion, reflecting an optimistic outlook.

Bottom Line

Lululemon’s impressive Q3 performance and optimistic outlook for the fourth quarter underscore its resilience and growth in the competitive market. Investors and enthusiasts can stay informed by exploring the provided links for in-depth analysis and real-time data.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4