You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Walmart’s Q3 FY24 Financial Triumph

Financial Results Overview

The multinational retail behemoth Walmart (WMT.US) beat market estimates in its third-quarter earnings report. The quarter’s overall sales of $160.8 billion shown a significant 5.2% year-over-year (YoY) rise, exceeding projections by $1.67 billion.

This strong success demonstrates Walmart’s tenacity and strategic acumen in negotiating the shifting market conditions.

Earnings Per Share (EPS) and Same-Store Sales

Walmart’s adjusted EPS stood at $1.53, outshining estimates of $1.52. Concurrently, the domestic same-store sales experienced a commendable growth of 4.7%, surpassing the anticipated 3.35%. These figures underscore Walmart’s ability to not only meet but exceed the expectations of both analysts and shareholders.

Insights from CEO Doug McMillon

Deflationary Outlook and Strategic Response

During the earnings call on November 16th, CEO Doug McMillon provided valuable insights into the company’s outlook. Acknowledging a potential phase of deflation in the U.S. consumer market, McMillon emphasized the proactive stance adopted by Walmart.

The company perceives deflation as an opportunity to provide added value to customers, showcasing a customer-centric approach even in challenging market conditions.

Cautious Full-Year Projections

Despite the stellar Q3 performance, Walmart exercised prudence in its outlook for the remaining year. The cautious approach is evident in the projection of full-year comparable sales, expected to increase by 5% to 5.5%. This surpasses the earlier estimated range of 4% to 4.5%, reflecting Walmart’s commitment to realistic and achievable targets.

Earnings Per Share Forecast

Walmart raised its full-year earnings per share forecast to a range of $6.40 to $6.48, surpassing the previous guidance of $6.36 to $6.46. However, this falls slightly below analysts’ expectations of $6.48. The nuanced projection aligns with Walmart’s commitment to transparent communication with stakeholders.

Market Response and Stock Performance

Post-Earnings Market Dynamics

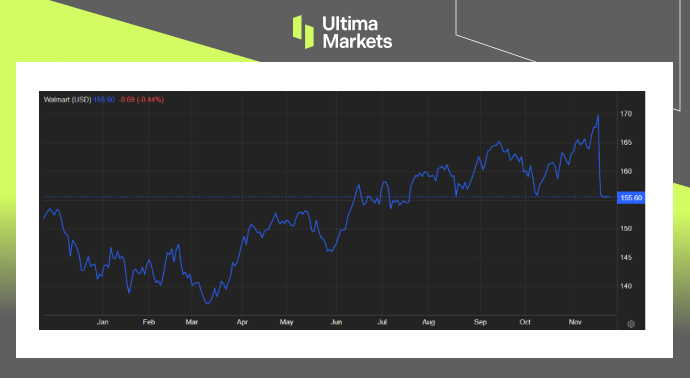

In the aftermath of the earnings report, Walmart’s stock experienced a slight dip, shedding 0.44% on November 17th and a cumulative 3.83% over the last four weeks. This nuanced market response indicates a measured reaction, acknowledging both the impressive financials and the cautious outlook presented by Walmart.

Long-Term Perspective

Despite the recent fluctuations, Walmart maintains a positive trajectory for the year, boasting a 3.41% gain in the last 12 months. This long-term perspective reaffirms Walmart’s resilience and sustained growth in the ever-evolving retail landscape.

(Walmart Stock Performance One-year Chart)

Bottom Line

In conclusion, Walmart’s Q3 FY24 earnings showcase a nuanced balance of financial triumphs and cautious projections, providing stakeholders with a comprehensive view of the retail giant’s strategic positioning in the market.

The company’s commitment to transparency, realistic projections, and customer-centric strategies positions Walmart as a key player in the ever-evolving retail landscape.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4