Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

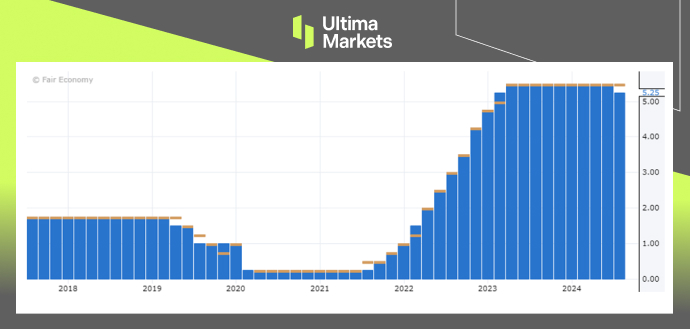

The Reserve Bank of New Zealand (RBNZ) has surprised markets by cutting its benchmark rate by 25 basis points to 5.25%, the first reduction since March 2020. This unexpected move, which indicates a pronounced dovish stance, comes as inflation approaches the 1% to 3% target range.

(RBNZ’s Official Cash Rate)

Previously, rate cuts were not anticipated by the RBNZ until mid-2025. However, New Zealand now aligns with a global trend towards monetary easing, joining other central banks that have also implemented interest rate reductions. The early rate cut which is ahead of the RBNZ’s prior forecasts has led to a decline in the kiwi. NZD/USD pair dipped 1.34%, closed at 0.59960.

(NZD/USD Daily Price Chart)

The central bank tempered its announcement with caution, underscoring that policy will need to stay restrictive for an extended period. Nonetheless, it projected that the cash rate would decline to 3.85% by the end of 2025. Market expectations for additional cuts mirrored the central bank’s gloomy economic forecasts.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server